January 25, 2026

Volume 13, Issue 4

Weekly Recap

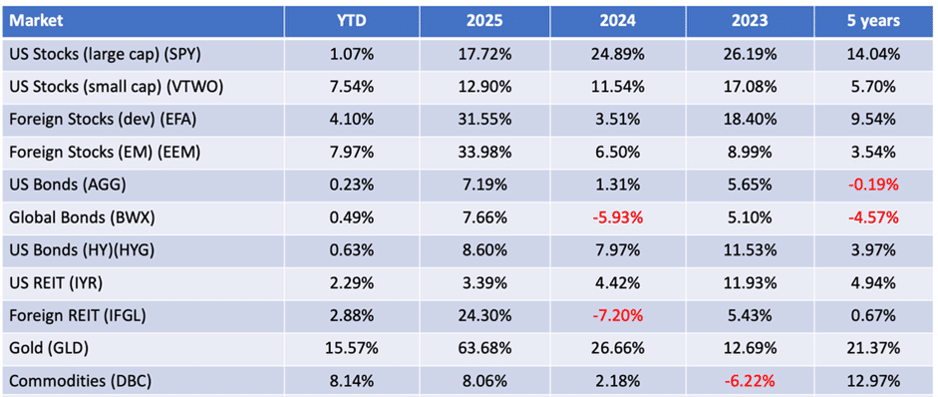

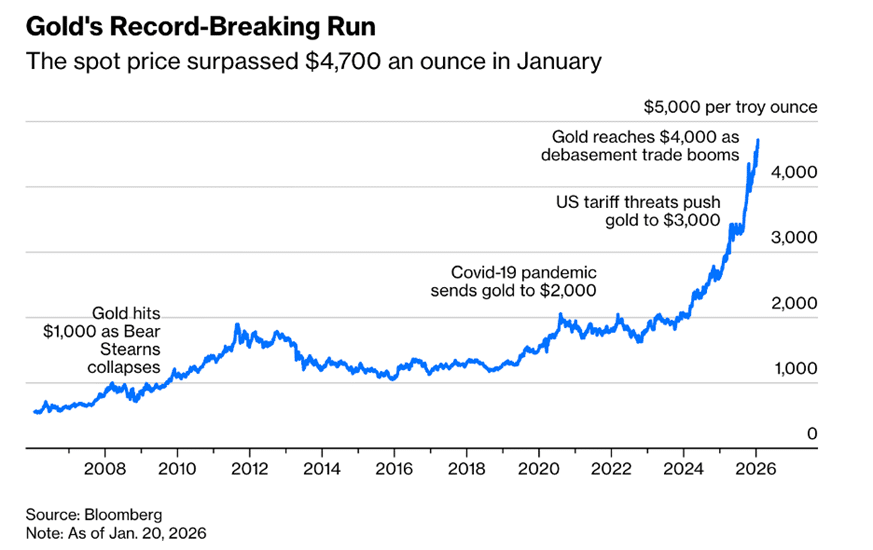

On Friday, the major domestic equity indexes finished a volatile, holiday-shortened week lower. The S&P MidCap 400 Index performed worst, falling 0.55 percent, followed by the Dow Jones Industrial Average and S&P 500, which declined 0.53 percent and 0.35 percent, respectively. Meanwhile, the Russell 2000 shed 0.32 percent, while the Nasdaq Composite closed just in the red. Amidst the volatility, gold surged higher still. Stocks traded sharply lower to start the week on Tuesday, with the S&P 500 posting its largest daily decline since October amid renewed fears of a global trade war after President Trump announced that he would impose new tariffs on European nations that opposed the U.S. purchasing or otherwise taking control of Greenland.

However, the major indexes reversed course on Wednesday after Mr. Trump appeared to soften his stance. In a social media post, Mr. Trump said that he and NATO Secretary General Mark Rutte had “formed the framework of a future deal with respect to Greenland” and that he would no longer “be imposing the Tariffs that were scheduled to go into effect on February 1st.” Stocks rallied on the news, ultimately finishing the week above their worst levels.

On the economic data front, an updated estimate from the Bureau of Economic Analysis showed that the U.S. economy grew at a faster-than-expected pace in the third quarter. The agency reported that real gross domestic product increased at an annual rate of 4.4 percent, a tick higher than a previous estimate of 4.3 percent and ahead of the second quarter’s 3.8 percent pace. The upward revision was largely driven by higher exports and investment.

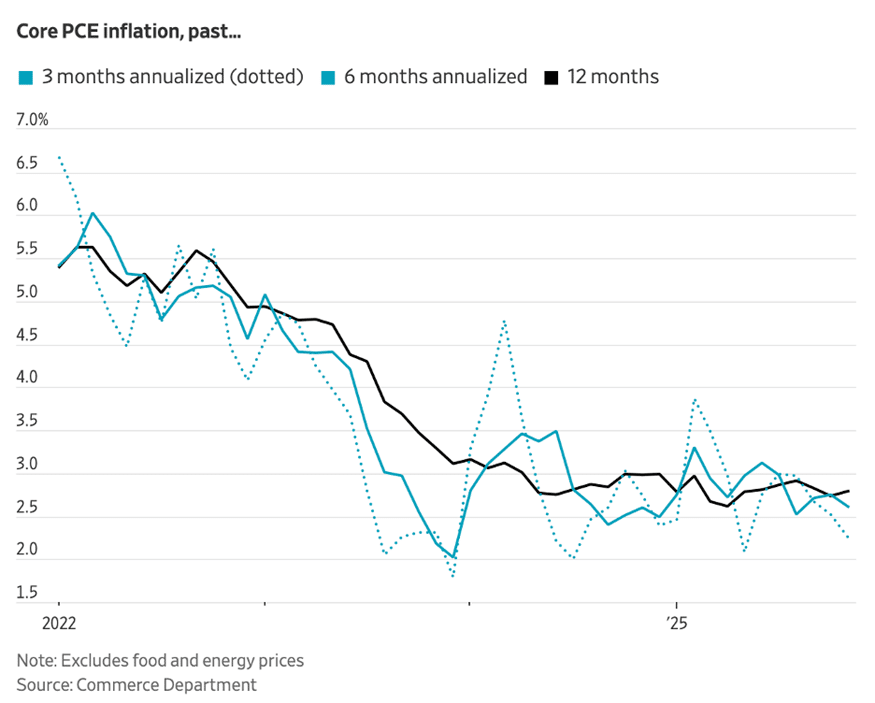

The BEA also released its November core personal consumption expenditures price index – the Federal Reserve’s preferred inflation gauge – which rose 0.2 percent from the prior month, in line with October’s reading. On a year-over-year basis, the index rose 2.8 percent, remaining well off of the Fed’s long-term inflation target of 2 percent. Last week’s employment data suggested that layoffs remain relatively subdued despite some signs of softening in the U.S. labor market. New applications for unemployment benefits for the week ended January 17 came in at 200,000, a slight increase from the previous week’s revised 199,000 and below estimates for around 207,000. The reading brought the four-week moving average down to 201,500, the lowest level in two years. Continuing unemployment claims came in at 1.849 million in the week ended January 10, a decrease from the prior week’s downwardly revised 1.875 million.

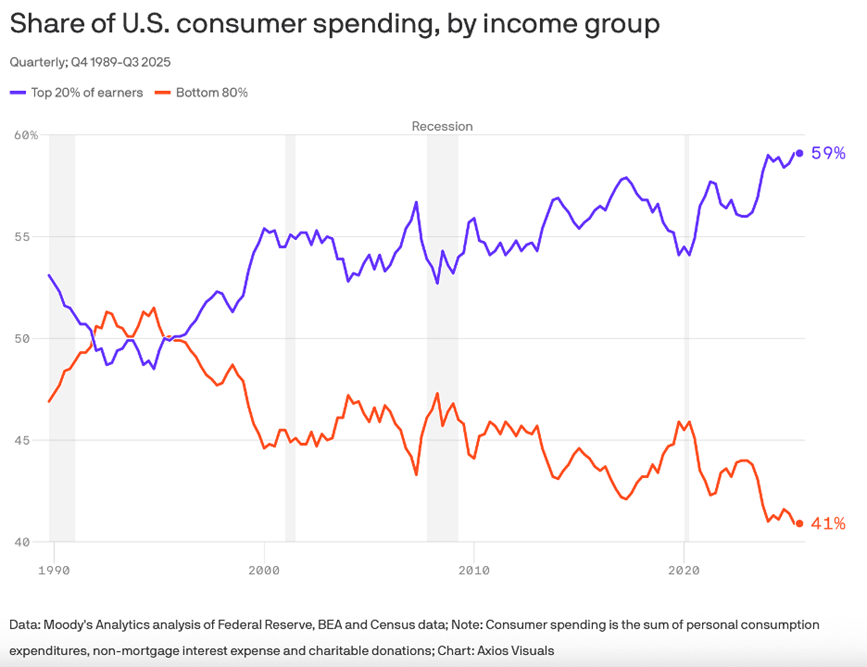

Meanwhile, the University of Michigan released the final January reading of its Index of Consumer Sentiment on Friday morning. The index reading came in at 56.4 for the month, up from 52.9 in December. However, the report also noted that January’s reading is over 20 percent lower year over year, “as consumers continue to report pressures on their purchasing power stemming from high prices and the prospect of weakening labor markets.”

Elsewhere, S&P Global reported that U.S. business activity growth inched higher in January, according to its Flash U.S. Composite Purchasing Managers’ Index. An acceleration in manufacturing growth outpaced growth in the services sector, and businesses’ confidence in the year ahead “remained positive but dipped slightly,” as “ongoing worries over the political environment and higher prices” offset optimism around economic growth prospects and demand conditions. U.S. Treasury securities were little changed last week. For the second week running, the benchmark 10-year U.S. Treasury note closed the week yielding 4.24 percent.

Market Monitor

A full listing of market performance data is available here.

DQYDJ.com (“Don’t Quit Your Day Job”) offers helpful investment calculators here, including one that shows total returns for individual stocks.

Koyfin.com provides reams of data on individual stocks, including the ability to track total return — and just about anything else — over time.

In the News

President Donald Trump said in a Truth Social post last Saturday that he would impose an additional 10 percent tariff on eight European countries – Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, and the U.K. – for deploying a small joint force to Greenland to conduct reconnaissance. Mr. Trump said the tariffs would take effect on February 1 and increase to 25 percent on June 1, adding they “will be due and payable until such time as a Deal is reached for the Complete and Total purchase of Greenland.” The leaders of the eight European nations responded in a joint statement, writing that “tariff threats undermine transatlantic relations and risk a dangerous The International Monetary Fund estimates that the world economy will grow by 3.3 percent this year, matching its 2025 growth rate.

President Trump continued to pressure European countries to help the U.S. acquire Greenland on Monday, including by telling NBC News, “no comment” when asked whether he would use military force to do so. Norwegian Prime Minister Jonas Gahr Støre also revealed yesterday that, in response to a request for a meeting, Mr. Trump texted him, “Considering your Country decided not to give me the Nobel Peace Prize for having stopped 8 Wars PLUS, I no longer feel an obligation to think purely of Peace, although it will always be predominant,” and demanded the U.S. control Greenland. Note, the Nobel Prize is not a governmental award and is based in Sweden.

Markets struggled Tuesday following President Trump’s tariff announcement targeting eight European countries and tied to their opposition to his Greenland ambitions. The tariff announcement sent the Dow Jones Industrial Average down 1.8 percent, while the S&P 500 fell 2.1 percent, its worst day since October, erasing its gains for 2026. The Nasdaq dropped 2.4 percent. European-based stock indices also decreased on Tuesday, though less steeply, and gold and silver prices reached record highs. Most importantly, bond yields surged higher. Meanwhile, the president emphasized that “there can be no going back” on Greenland. President Trump announced Wednesday that he had agreed to a “framework of a future deal” with NATO Secretary-General Mark Rutte, which he said would apply to the “entire Arctic Region,” in addition to Greenland. He also said he would suspend his planned tariff hikes on eight European countries that opposed his efforts to acquire the Danish island. The details of the framework have yet to be made public, but CNN reported that it would include renegotiating the terms of a 1951 U.S.-Greenland defense agreement that established U.S. military presence on the island. Axios reported that the U.S. would also maintain recognition of Denmark’s sovereignty over Greenland. Several outlets also reported that NATO leaders had discussed a deal to allow the U.S. to build more military bases in Greenland on land that would be considered American territory.

The Personal Consumption Expenditures price index – the Fed’s favored inflation measurement – rose to 2.8 percent year-over-year in November, up 0.1 percent from the month before.

The U.S. and China reportedly agreed to a deal allowing a group of mostly U.S. investors to acquire the U.S.-based business of TikTok.

The top 1 percent of households controlled 31.7 percent of the nation’s wealth in the third quarter of 2025, according to Federal Reserve data. That amounted to $55 trillion, nearly as much as the bottom 90 percent combined.

The International Monetary Fund estimates that the world economy will grow by 3.3 percent this year, a solid level, matching its 2025 growth rate.

The Supreme Court heard oral arguments last week in Trump v. Cook, which concerns the president’s attempt to fire a member of the Federal Reserve Board of Governors.

The U.S. has long been a beacon of safety when uncertainty reigns. That is changing. Retirement saving made funny.

Charts of the Week

I found the following articles to be of note. Some may be of interest only to advisors while others are aimed more broadly. You may hit paywalls below; many can be overcome here.

- Rules Matter More Than Insight (The Financial Pen)

- The Risk of Higher Inflation (Peter Orszag)

- Is the Market Underpricing the Risk of Fed Hikes? (Matthew Klein)

This is the best thing I’ve read recently. The sweetest. The saddest. The loveliest. The most sensible. Backcountry rescue. Dishonor. The importance of institutions. Money and meaning. RIP, Gladys West, a mathematician whose work was foundational in developing GPS technology, who died last week at age 95. Happy 250th, Jane Austen. 50 things.

Pizza chains in the United States generated $31 billion in sales in 2024, when one in every 10 Americans ate a slice each day. That said, pizza’s dominance is now threatened, as the number of pizza restaurants peaked in 2019 and has been in decline since. Pizza in general has ceded ground to other cuisines in the United States, dropping from the second-most popular cuisine in the 1990s to the sixth in 2024. It had since been outnumbered by coffee shops and Mexican restaurants, among others.

“Micro is what we do, macro is what we put up with.”

~ Charlie Munger

Securities and advisory services are offered through Madison Avenue Securities, LLC, a member of FINRA and SIPC, a registered investment advisor. This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures, or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment, or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.