November 16, 2025

Volume 12, Issue 47

Weekly Recap

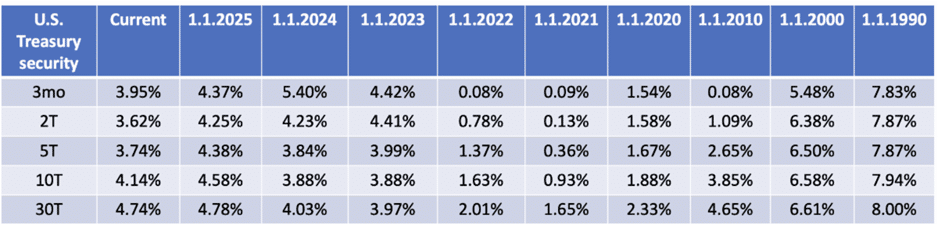

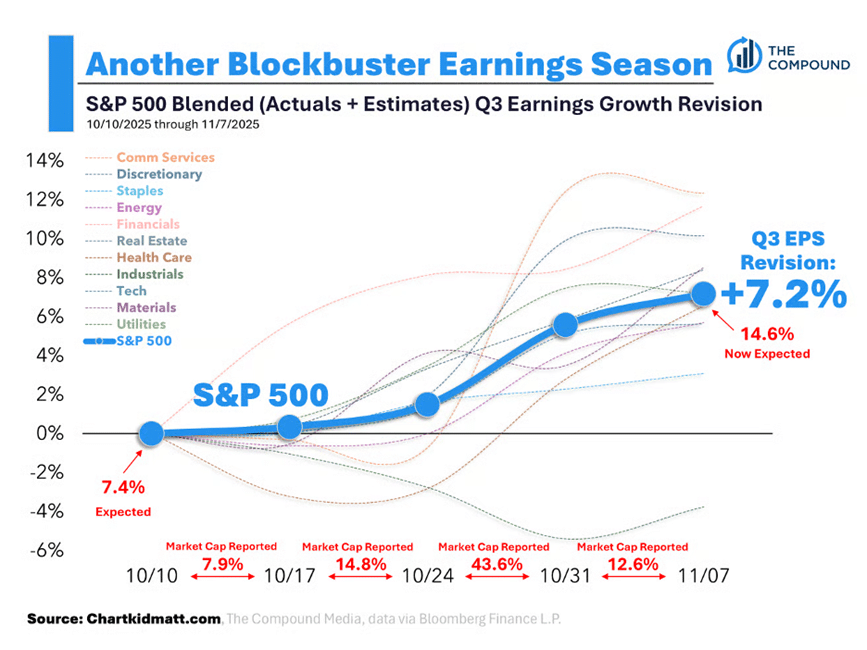

Domestic equities closed mixed last week, as the Dow Jones Industrial Average and S&P 500 posted modest gains while the Nasdaq Composite, S&P MidCap 400, and small-cap Russell 2000 lost ground. Stocks were mostly lower through Thursday, as concerns regarding elevated valuations and increased scrutiny around artificial intelligence spending seemed to help drive a rotation away from many of the growth-oriented stocks that have helped propel indexes to recent all-time highs. However, a volatile trading session on Friday with limited major headlines led to some indexes recovering their losses and closing last week higher. In more positive news, the longest U.S. government shutdown on record came to an end on Wednesday night after President Trump signed a spending bill that will keep the government funded through January 30. While the news helped remove a major headwind for markets, stocks traded sharply lower on Thursday as questions still remain around how long it will take for conditions to return to normal.

Economic data in particular remained a focal point. White House representatives stated that October jobs and inflation reports may never be released, and the Bureau of Labor Statistics added that “it may take time to fully assess the situation” with regard to finalizing data release dates. On Friday afternoon, the BLS announced that it will release its September jobs report on Thursday, November 20.

Hawkish commentary from several Federal Reserve policymakers also appeared to weigh on equity markets. Speaking Wednesday, Atlanta Fed President Raphael Bostic stated that he considers “signals from the labor market as ambiguous and difficult to interpret” and believes that they are “not clear enough to warrant an aggressive monetary policy response when weighed against the more straightforward risk of ongoing inflationary pressures.” He also believes current monetary policy is “marginally restrictive” and favors keeping interest rates steady “until we see clear evidence that inflation is again moving meaningfully toward” the central bank’s 2 percent target.

Meanwhile, St. Louis Fed President Alberto Musalem said he believes policymakers “need to proceed and tread with caution,” while Cleveland Fed President Beth Hammack said she believes that monetary policy needs to “remain somewhat restrictive” due to concerns about persistently high inflation. The probability of a rate cut following the Fed’s December meeting declined to around 46 percent as of Friday, down from about 67 percent the prior Friday and close to 95 percent a month ago, according to the CME FedWatch tool. Small-cap stocks, which can be more sensitive to interest rate movements, underperformed last week, with the Russell 2000 dropping 1.83 percent.

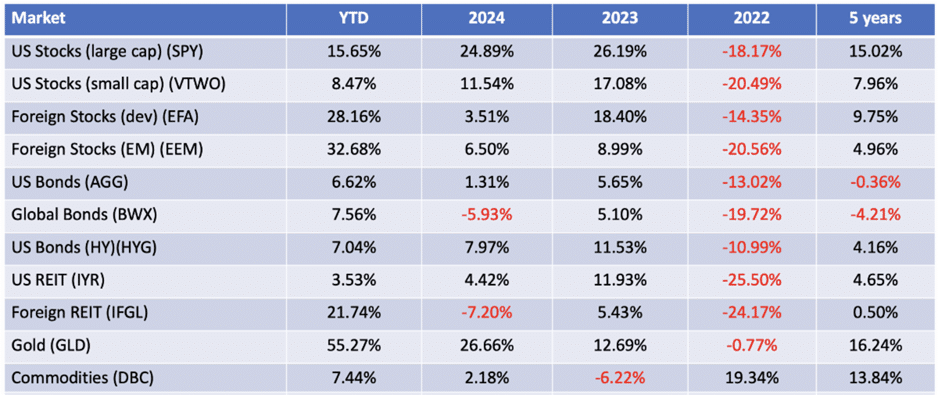

Yields moved higher across the yield curve last week as Fed easing expectations diminished. The benchmark 10-year U.S. Treasury note closed the week yielding 4.14 percent.

Market Monitor

A full listing of market performance data is available here.

DQYDJ.com (“Don’t Quit Your Day Job”) offers helpful investment calculators here, including one that shows total returns for individual stocks. Koyfin.com provides reams of data on individual stocks, including the ability to track total return — and just about anything else — over time.

In the News

President Trump signed a temporary government funding bill Wednesday night, ending the longest federal shutdown in U.S. history after 43 days. Two hours earlier, the House of Representatives approved the funding package in a 222-209 vote, with six congressional Democrats joining ranks with Republicans to support the bill. The continuing resolution passed the Senate earlier this week after eight Democratic senators agreed to a bill with Republicans, securing the necessary 60 votes to invoke cloture and advance the legislation to the House. Mr. Trump urged voters to oppose Democratic candidates who he said were responsible for the shutdown, stating on Wednesday, “When we come up to midterms and other things, don’t forget what they’ve done to our country.”

China raised $4 billion in dollar-denominated bonds. In comparison to other issuers, or to China’s own capital markets, and especially to U.S. Treasury paper, the amount is trivial. However, the three-year and five-year bonds were issued at the same yields as equivalent U.S. Treasury securities. In other words, since U.S. paper provides the “risk-free rate,” Chinese paper was deemed essentially risk-free.

Big stock gains have always been followed by big losses. Here are tips on how to prepare.

Will President Trump’s trade war break America’s addiction to cheap stuff?

Last week, investment firm SoftBank sold its stake in chipmaker Nvidia, pocketing $5.8 billion to help bankroll other AI bets. Stocks dipped a little in response, as the Japanese firm’s move added to questions over the pricy valuations of many AI-focused companies. Even a top SoftBank executive wondered aloud if we might now be in a bubble.

The federal government shutdown canceled a second straight jobs report, but private data sources suggest the labor market has weakened modestly since summer. Once the U.S. government reopens, much-anticipated jobs reports and inflation updates will provide crucial insights. However, White House press secretary Karoline Leavitt told reporters that – due to the data-gathering issues during the government shutdown – the October inflation and jobs reports from the Bureau of Labor Statistics will likely never be released.

The last three Fed policy votes have featured some form of dissent, as officials grapple with how to weigh a softening labor market and resurgent inflation.

Americans aged 70 and older own almost 40 percent of all stocks in the U.S. and those 55 and older own over half of all homes.

Facebook parent Meta makes 10 percent of its revenue from ads for scams. Production of the penny coin concluded in Philadelphia last week after years of agitation for phasing out the coin. People cited the four cents it costs to produce a penny and the diminished utility of a one-cent piece. The production phase-out has not been seamless; constrained supply without clear messaging has meant shortages for convenience stores and the like. Even still, after entering circulation in 1793, all the pennies that will ever be made have indeed been made. The final pennies will be auctioned off. This is kind of a big deal since the last time a U.S. coin was discontinued was the half-cent piece in 1857.

Charts of the Week

I found the following articles to be of note. Some may be of interest only to advisors while others are aimed more broadly. You may hit paywalls below; many can be overcome here.

- The Ideal Level of Wealth (Nick Maggiulli)

- What Short-Term Fund Performance Tells Us About Future Returns (Sotiroff & Gorbatikov)

- Tax-Aware Portfolio Construction (Vanguard)

- The End of the Affair (Henry Neville)

- Capital Allocation (Mauboussin & Callahan)

This is the best thing I’ve read recently. The best illusion. The most predictable. The most thought-provoking. Competitive pumpkin growing. Airline travel has gotten safer, cheaper, and less reliable. AI isn’t replacing radiologists.

A popular Boston-area university has been consumed by an internal report arguing that grade inflation at Harvard has gotten completely out of hand. In the 2005-06 school year, 25 percent of all grades were As; in the 2024-25 school year, 60 percent of grades were As. The average time students spent studying has remained flat — (only) 6.08 hours per week in fall 2006 to (only) 6.3 hours as of last spring — and the median GPA — the median! — upon graduation is 3.89, up from 3.29 in 1985. Not surprisingly, proposed solutions to rein in the issue have been opposed by Harvard students.

“Habit rules the unreflecting herd.”

~ William Wordsworth

Securities and advisory services are offered through Madison Avenue Securities, LLC, a member of FINRA and SIPC, a registered investment advisor. This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures, or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment, or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.