November 2, 2025

Volume 12, Issue 45

Weekly Recap

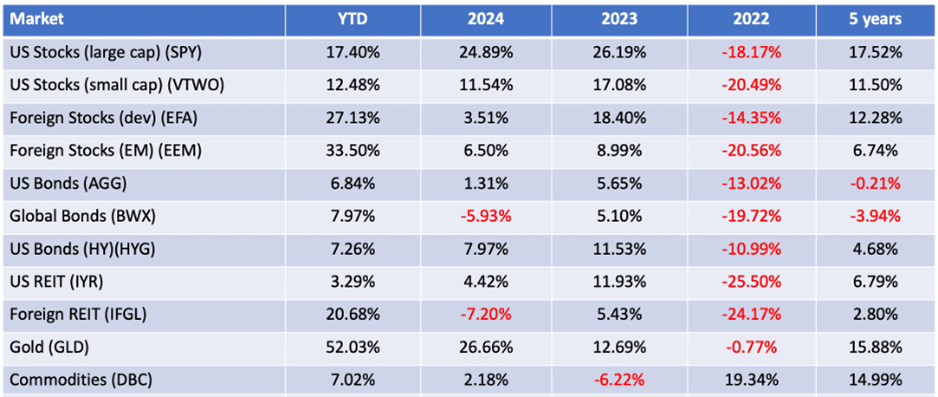

Domestic equities closed mixed last week, with large-cap indexes posting gains and smaller-cap indexes declining. The technology-heavy Nasdaq Composite led the way for the major indexes, boosted by continued outperformance from the mega-cap technology companies benefiting from artificial intelligence spending. Market breadth was notably narrow, however, as the S&P 500 advanced despite seven of its 11 sectors losing ground, and an equal-weighted version of the index underperformed the market-cap weighted index by 268 basis points (2.68 percentage points).

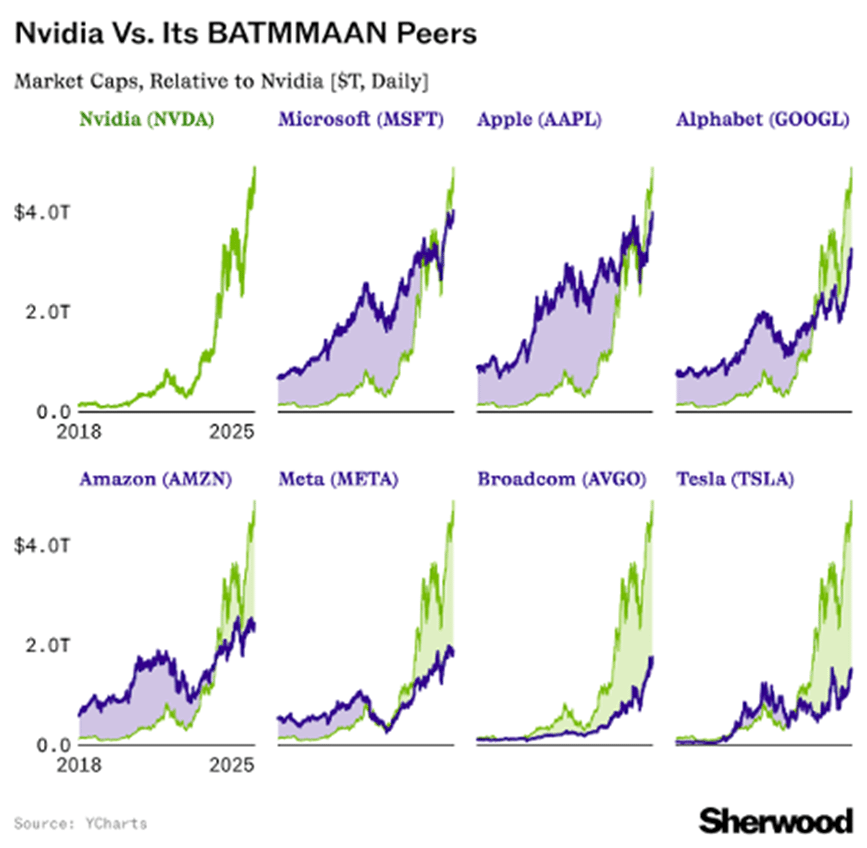

Third-quarter earnings season continued to ramp up with over one-third of S&P 500 companies reporting results, including five of the so-called Magnificent Seven companies. According to data from FactSet, 64 percent of S&P 500 companies have reported results, with 83 percent posting earnings that beat consensus estimates. Reactions to the week’s Magnificent Seven earnings were mixed, with shares of Microsoft, Apple, and Meta Platforms declining after reporting, while Amazon and Alphabet traded higher. Elsewhere, shares of NVIDIA rose and pushed the chipmaker’s market capitalization over $5 trillion midweek, making it the first company to ever cross that threshold.

Heading into last week, much of the attention was on a Thursday meeting in South Korea between President Trump and Chinese President Xi Jinping to discuss trade relations between the world’s two largest economies. The leaders agreed to a one-year trade truce, which will see a reduction of U.S. tariffs on Chinese imports, a suspension of China’s export controls on rare earth materials, and a resumption of China’s purchases of U.S. soybeans and other agricultural products. While the concessions in the agreement were relatively modest and left room for further trade war escalation in the longer-term, the outcome provided some temporary relief and helped boost sentiment.

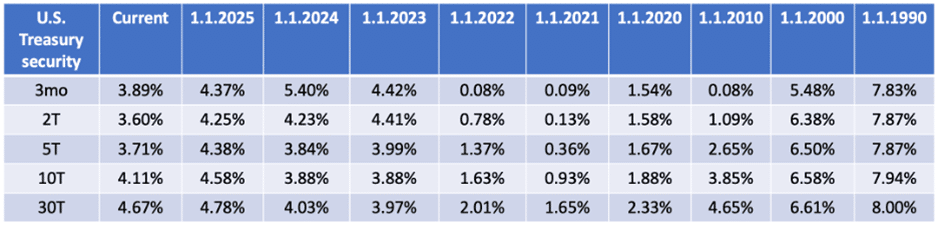

The other major event on the calendar last week was the Federal Reserve’s October monetary policy meeting. On Wednesday, the central bank announced that it would lower its target range for the federal funds rate by 25 basis points (0.25 percentage points) to 3.75–4.00 percent, as was widely expected.

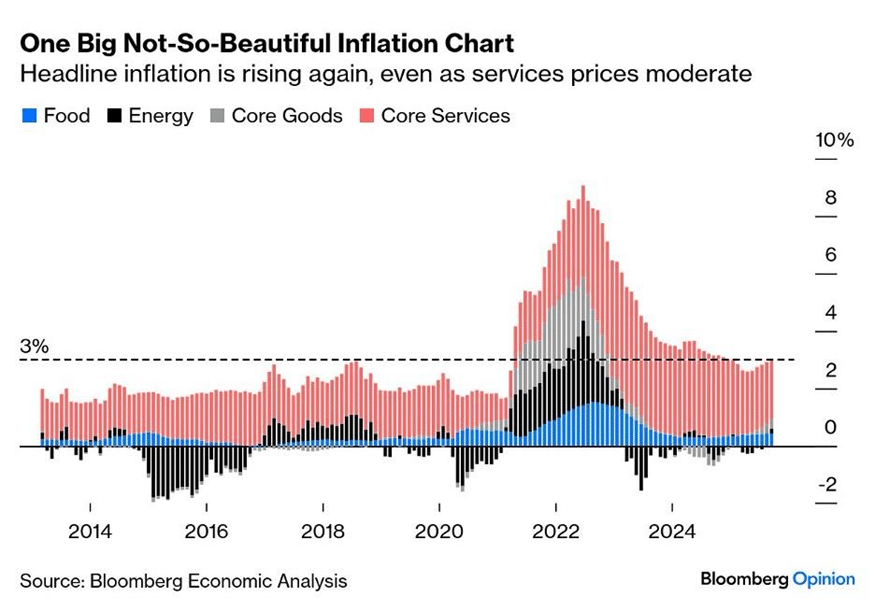

Notably, however, two policymakers dissented, with Fed Governor Stephen Miran favoring a 50-basis-point cut and Kansas City Fed President Jeffrey Schmid voting to keep rates unchanged. The dissents highlighted the growing divide between Fed officials as they attempt to determine the appropriate path forward amid persistently above-target inflation and a weakening labor market. Speaking after the meeting, Fed Chair Jerome Powell pushed back against investors who were expecting further easing this year, stating that another rate cut at the central bank’s December meeting “is not a foregone conclusion.” Powell also suggested that, given the lack of economic data due to the ongoing federal government shutdown, policymakers could take a more cautious approach in December.

\ U.S. Treasury securities generated negative returns last week as yields fluctuated but ultimately finished the week higher across most maturities. The conclusion of the Fed’s monetary policy meeting on Wednesday, and subsequent hawkish comments from Mr. Powell, drove much of the yield movement for the week.

Market Monitor

A full listing of market performance data is available here.

DQYDJ.com (“Don’t Quit Your Day Job”) offers helpful investment calculators here, including one that shows total returns for individual stocks. Koyfin.com provides reams of data on individual stocks, including the ability to track total return — and just about anything else — over time.

In the News

The Federal Reserve’s Open Markets Committee cut interest rates by a quarter of a percentage point on Wednesday to a range of 3.75-4 percent. The vote by the 12-person committee included two dissents. Governor Stephen Miran, who was appointed to the Federal Reserve by President Trump in September, dissented in favor of a half-percentage-point cut, his second consecutive dissent in favor of looser economic policy. Kansas City Fed President Jeffrey Schmid also dissented, but preferred that the Fed hold rates steady. During his press conference after the meeting, Federal Reserve Chair Jerome Powell told investors not to count on another rate cut at the Fed’s next meeting. Because of the government shutdown, there is very limited data available, meaning the Fed is largely flying blind. The shutdown has cost $18 billion so far. Inflation isn’t totally under control (2 percent is the goal, not 3 percent), but the labor market is increasingly wobbly, especially now thanks to sweeping job cuts that might be due to a correction from over-hiring during the pandemic. Unless it’s automation.

President Donald Trump and Chinese leader Xi Jinping met in South Korea on Thursday, where the two leaders agreed to a broad one-year trade deal. China agreed to crack down on fentanyl, restart buying American energy and soybeans, and delay its export controls (notably of rare earth minerals) for one year. In return, the White House committed to reducing the fentanyl-related tariff on China from 20 to 10 percent – bringing the average import levy on Chinese goods to 45 percent. Both sides also agreed to end docking fees for vessels stopping at one another’s ports. Trump said he discussed semiconductors with Xi, adding that NVIDIA would consider exporting Blackwell AI processors to Beijing. Trump told reporters that he plans to visit China for another meeting with Xi in April, and, on a later date yet to be determined, China’s leader would visit the United States. Still, the truce seems more cause for relief rather than celebration; the two sides have holstered their weapons, not discarded them.

Nearly 42 million people lost SNAP food aid Friday due to the second-longest U.S. government shutdown ever, as Congress continues in legislative stalemate. Worth watching: Walmart captures 25 percent of SNAP dollars.

On Monday, Treasury Secretary Scott Bessent confirmed that President Trump has narrowed his list of candidates to succeed Federal Reserve Chair Jerome Powell, whose term expires at the end of January 2026, to five people.

Americans hate talking about money. Per data from the Federal Reserve, America’s households now possess$167 trillion in wealth as of the end of the second quarter. Given the Census Bureau estimates that there are about 132 million households in America, that means the

average U.S. family is worth more than a million bucks. However, because the wealth of America’s top one percent stands at $52 trillion as of Q2, or nearly one-third of the nation’s total wealth, average isn’t the best measure. In 2022, Fed data put U.S. median household wealth at around $193,000. Though that’s almost surely risen since, it suggests the true “typical” American household, at the 50th percentile of America’s wealth ladder, is likely closer to $200,000 than over a million.

Over half of Americans who make below $80,000 per year now have taxable investment accounts, with half of those investors entering the market within the last five years.

Apple’s market capitalization surpassed $4 trillion on Tuesday, only the third publicly traded stock to reach that benchmark. On Tuesday, NVIDIO CEO Jensen Huang told an audience at the company’s GTC conference that orders for their Blackwell and early Rubin chips were above $500 billion through 2026, and announced a bevy of new partnerships with top companies like Palantir, CrowdStrike, and Uber — pushing the company’s market cap to $4.9 trillion at the close. Wednesday, following a barrage of positive analyst coverage, NVIDIA crossed the $5 trillion threshold, becoming the first company to reach that valuation. Even so, the company is emerging as a villain in U.S. tech policy; the chipmaker really wants to be allowed to sell advanced technology to China, and is aggressively trying to undermine anyone who raises national security objections. David Cowan makes the case here: NVIDIA Is A National Security Risk. Steven Adler goes further, arguing there is “widespread fear” among think tank researchers who publish work against NVIDIA’s interests. One might think all would be in agreement that handing key military tech to rivals is a bad idea, but it’s not at all clear which way this will end up going.

Charts of the Week

I found the following articles to be of note. Some may be of interest only to advisors while others are aimed more broadly. You may hit paywalls below; many can be overcome here.

- 10 questions to answer before you die (Maura McInerney-Rowley)

- Just What the Doctor Ordered (Ben Inker)

- Long-Term Asset Return Study (Deutsche Bank Research)

This is the best thing I’ve read recently. The scariest. The most absurd. The most inspiring. The most bizarre. Silicon Valley honeytraps. Girls Gone Bible. The waltz. Restaurant opening. Return decay illustrated. Fat squirrel. Pumpkin stylists. Persecution in China. Setlist.fm. Flag cones. Silicon Valley sperm donor search startup called – of course – PreSeed. A newly discovered Dr. Seuss manuscript, Sing the 50 United States!, will hit shelves next June to celebrate America’s 250th birthday. The Parallel Parking Championship.

Monday was the sports equinox, the only day in 2025 that fans could tune into games across all four major American sports leagues (MLB, NBA, NFL, and NHL) plus MLS in the same evening.

“To await certainty is to await eternity.” ~ Jonas Salk

Securities and advisory services are offered through Madison Avenue Securities, LLC, a member of FINRA and SIPC, a registered investment advisor. This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures, or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment, or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.