November 23, 2025

Volume 12, Issue 48

Weekly Recap

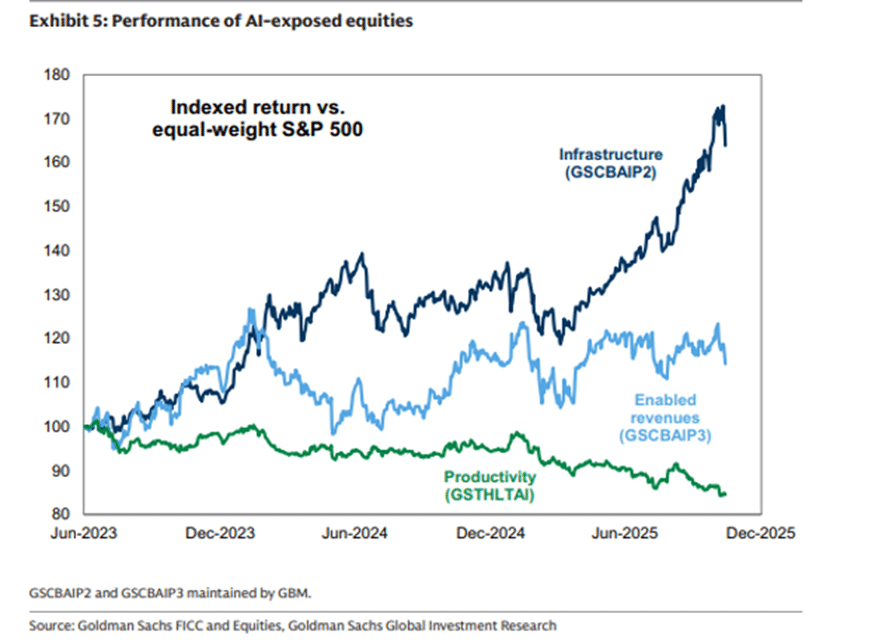

Despite some good news during the week from both corporate earnings reports and government economic data, domestic equities closed lower last week. The sell-off appeared to be driven by worries about lofty stock valuations and concerns around whether artificial intelligence will generate enough profits to justify the massive spending that companies have poured into supporting the developing technology. The tech-heavy Nasdaq Composite had the largest losses, while the S&P MidCap 400 and Russell 2000 held up better, though they still lost ground. The large-cap S&P 500 finished about 4.4 percent lower than the record high it achieved in late October. A rebound during a volatile day of trading on Friday helped ease the losses that the major benchmarks suffered earlier in the week.

In probably the most anticipated earnings report of the quarter, chipmaker NVIDIA, the largest company by capitalization in the S&P 500, reported record revenue on Wednesday evening that exceeded analysts’ expectations, driven by strong demand for its AI chips. The company also provided a healthy revenue forecast for the fourth quarter that surpassed consensus estimates.

The market initially reacted favorably to the news when trading opened on Thursday, but sentiment turned negative later in the morning, and NVIDIA finished 3 percent lower for the day and pulled the major benchmarks down with it. There did not appear to be a specific catalyst for the reversal other than a resumption of the AI-related worries that had weighed on markets in the days leading up to NVIDIA’s earnings release.

The market also digested some other key reports that were released early Thursday. Walmart, the largest retailer and private employer in the U.S., delivered strong results, especially in its e-commerce business, that beat consensus estimates, and the company also raised its full-year financial outlook.

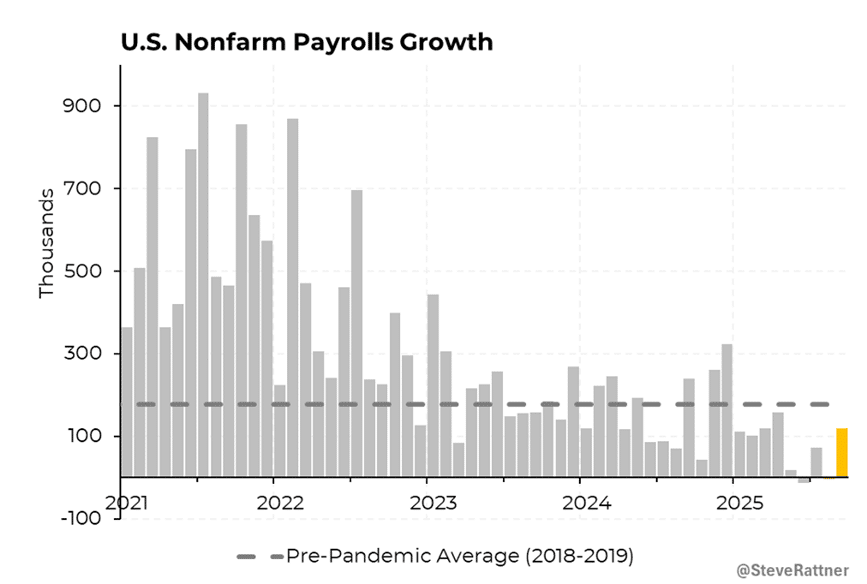

Meanwhile, the Labor Department’s monthly employment report for September, which was delayed for six weeks by the government shutdown, was finally released on Thursday and provided a somewhat conflicted view of the economy. The report showed that U.S. employers added 119,000 jobs for the month, significantly higher than expected, and much better than over the summer when hiring virtually stopped. Less encouragingly, the unemployment rate, which is computed in a separate survey, ticked up to 4.4 percent in September, its highest level in four years, from the previous month’s 4.3 percent. The Bureau of Labor Statistics also announced that the next employment report, covering November, would be released on December 16 (the October report has been canceled).

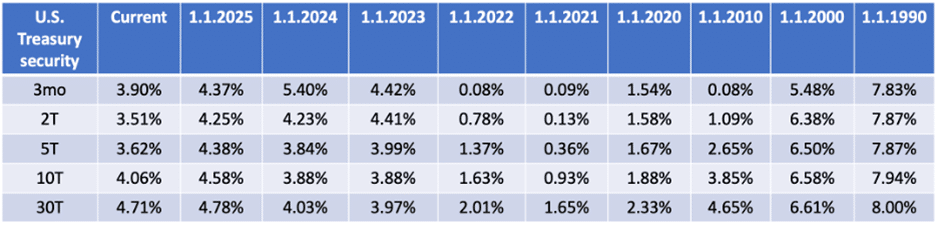

Traders remain focused on whether Federal Reserve policymakers will cut rates again when they meet on December 9–10. The minutes from their October meeting indicated considerable skepticism about the need for an additional cut in December. However, comments on Friday morning by John Williams, the president of the New York Fed, seemed to support a near-term rate cut and appeared to boost sentiment in equity markets on Friday.

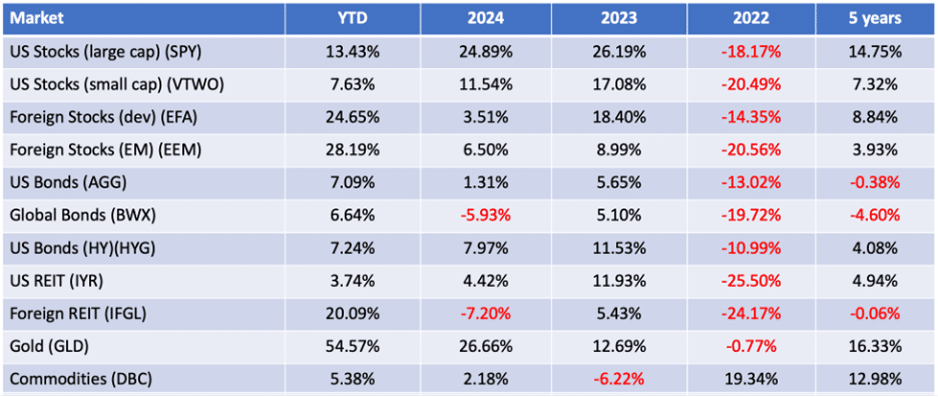

According to CME Group data based on the futures markets, as of Friday, there was a nearly 70 percent chance that the Federal Reserve would cut rates at its next meeting, up from 44 percent a week earlier. U.S. Treasury securities generated positive returns across the yield curve last week, with yields trending down throughout the week. The belly of the curve performed best. The benchmark 10-year U.S. Treasury note closed last week yielding 4.06 percent.

Market Monitor

A full listing of market performance data is available here.

DQYDJ.com (“Don’t Quit Your Day Job”) offers helpful investment calculators here, including one that shows total returns for individual stocks. Koyfin.com provides reams of data on individual stocks, including the ability to track total return — and just about anything else — over time.

In the News

The September jobs report – which was released Thursday, seven weeks late due to the government shutdown – showed that the U.S. economy added 119,000 jobs in September, exceeding economists’ expectations. The unemployment rate, however, ticked up from 4.3 percent in August to 4.4 percent, the highest level in four years. August’s job report, which initially showed a gain of 22,000 jobs, was revised downward to show a loss of 4,000 positions. The information, showing the last month of hiring and firing before the government shutdown began, gives no clear signal to the Federal Reserve, which is currently deliberating whether to cut interest rates or to hold them steady at its December meeting. Due to the shutdown, the Bureau of Labor Statistics will not publish the October jobs report and will delay the release of the November numbers.

The U.S. trade deficit dropped 24 percent in August, mainly due to President Donald Trump’s tariff policies, according to a Commerce Department report released on Wednesday. The difference between the value of goods the U.S. imports from other countries and the value of its exports was $59.6 billion in August, down from $78.2 billion in July. The change was driven by declining imports, which fell by 5 percent, compared with a 0.1 percent increase in exports.

Nvidia reported record third-quarter earnings on Wednesday, comfortably exceeding Wall Street expectations, with revenue of $57 billion – up 62 percent from a year ago. Nvidia also provided fourth-quarter revenue guidance of $65 billion – $3 billion above forecasts – with CEO Jensen Huang saying demand for the company’s Blackwell chip is “off the charts.” Huang also directly addressed worries about an AI bubble, saying, “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.” However, over 60 percent of Nvidia’s sales come from four big customers, and depend on still-unproven bets on generative-AI infrastructure. Shares rose more than 5 percent in extended trading following the announcement, putting the company’s value up 39 percent since the start of the year, at $4.5 trillion. Nvidia alone is 8 percent of the S&P 500’s total market capitalization, and a poor quarter for the company would have significant impacts on the entire U.S. stock market.

U.S. consumer sentiment fell in November to one of the lowest levels on record as Americans’ views of their personal finances soured. America’s C-suite is turning over at its fastest pace in decades. CEO exits hit a record high in 2024, according to outplacement firm Challenger, Gray & Christmas, which has tracked departures since 2002 — and 2025 is looking to be almost as intense. So far this year, 1,650 CEOs have departedthrough September, essentially matching the 1,652 logged over the same period in 2024. Last Friday, Walmartannounced that its longtime CEO, Doug McMillon, will step down next January, ending nearly 12 years at the helm — a period during which Walmart’s share price has risen more than 300 percent. McMillon is hardly alone in calling time on his big job. Fellow retailers have seen turnover, too, including Kohl’s CEO Ashley Buchanan (who lasted just five months) and Target’s veteran Brian Cornell, who also plans to step down next January. Big Tech has also seen changes at the top: X’s Linda Yaccarino exited in July, and Spotify’s Daniel Ek said in September he’ll shift into the company’s executive chairman role after 20 years as CEO.

The race to be Fed Chair.

Wall Street has blown by bubble worries to supercharge AI spending spree.

The hedge fund Thiel Macro, run by billionaire Peter Thiel, sold its entire $100 million Nvidia stake, and reduced its stake in Tesla. While previous studies have extensively analyzed individual safe haven assets like gold or U.S. Treasury bonds, three academics have taken a different approach. They asked: Do safe haven assets move together as a cohesive market, similar to how individual stocks comprise the broader stock market? To answer this question, the authors constructed a Safe Haven Index using nine different assets: Gold; two major currencies (Swiss franc and Japanese yen); and six government bonds (U.S. and German bonds with 2-year, 10-year, and 30-year maturities).

Charts of the Week

I found the following articles to be of note. Some may be of interest only to advisors while others are aimed more broadly. You may hit paywalls below; many can be overcome here.

- 10 Things We Can Learn From Warren Buffett That Have Nothing to Do With Money (Dan Lefkovitz)

- Stock Markets Are Spooked by Fed Rate-Cut Doubts (Barron’s)

- 9 New Retirement Numbers to Know for 2026 (Melanie Waddell)

This is the best thing I’ve read recently. The coolest. The smartest. World Sauna Championships. Mickey D’s. Dueling portraits. Costco.

Cooking a Thanksgiving dinner for your friends and family will cost less than last year, marking the third straight year of price declines. The American Farm Bureau Federation’s 40th annual Thanksgiving dinner survey provides a snapshot of the average cost of Thanksgiving staples that make up a classic holiday feast for 10, which is $55.18 or about $5.52 per person. This is a 5 percent decrease from 2024. However, three years of declines don’t fully erase dramatic increases that led to a record-high cost of $64.05 in 2022.

“The world is movement, and you cannot be stationary in your attitude toward something that is moving.”

~ Henri Cartier-Bresson

Securities and advisory services are offered through Madison Avenue Securities, LLC, a member of FINRA and SIPC, a registered investment advisor. This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures, or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment, or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.