April 7, 2024

Volume 11, Issue 14

Weekly Recap

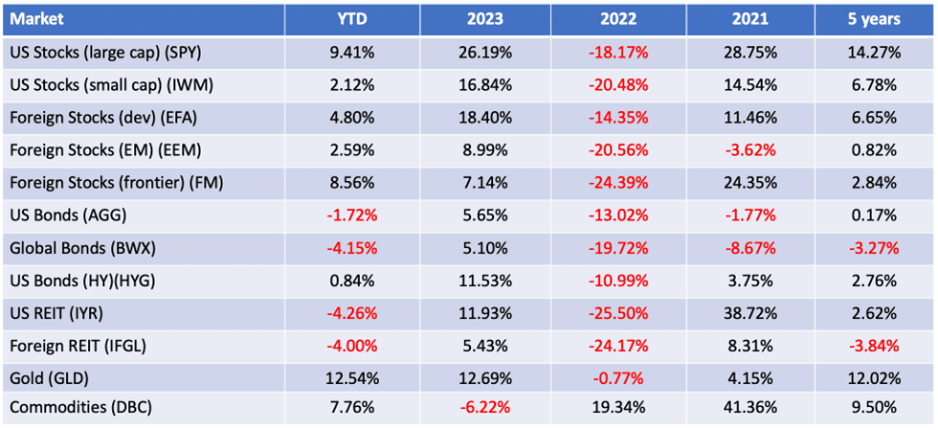

The large-cap domestic equity indexes pulled back from record highs last week, as U.S. Treasury yields increased in response to signs that the manufacturing sector might finally be gaining traction. The market’s performance also narrowed again, with growth stocks faring better than value shares and large-caps falling less than small-caps. Energy stocks outperformed as oil prices reached their highest level since October on worries over rising tensions between Israel and Iran and a decision by major exporters to maintain production limits despite tight markets. Some late strength in Microsoft boosted the technology sector.

The Institute for Supply Management’s separate indexes of service and manufacturing sector activity seemed to play a particular role in driving sentiment over the week. Stocks moved lower following the release of the March ISM manufacturing reading on Monday, which came in well above expectations and indicated expansion – if barely – for the first time in 16 months. More concerningly from an inflation perspective, the ISM prices paid index also surprised handily on the upside, seemingly confirming recent data showing a rebound in input prices.

Conversely, the ISM services report, released Wednesday, appeared to ease worries. While still indicating expansion, the services index fell back for the second consecutive month and, more significantly, the index of prices paid fell back to its lowest level since pandemic lockdowns began in March 2020. The data seemed to increase hopes for a June Federal Reserve rate cut, as reflected in futures prices.

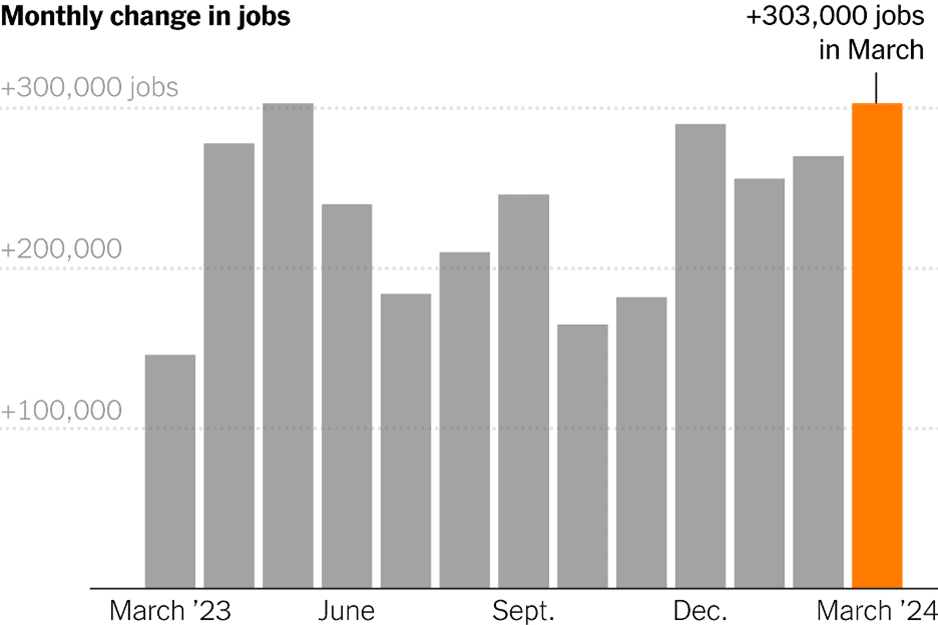

The Friday jobs report from the Labor Department, typically among the most closely watched indicators of growth and inflation pressures, appeared to further reassure investors. Employers added 303,000 jobs in March, well above expectations and the most in nearly a year. Encouragingly, from a wage pressures standpoint, the solid gains came with only a modest increase in average hourly wages, from 0.2 percent in February to 0.3 percent in March. Part of the reason may have been a solid rise in the labor force participation rate, suggesting that employers might be enjoying an easier time filling empty slots. Equity investors appeared to welcome the signs of a healthy economy in the jobs report, but the yield on the benchmark 10-year U.S. Treasury note jumped higher on the news. Earlier in the week, it hit its highest intraday level since late November. Indeed, yield rose across the yield curve and gold rallied hard.

Market Monitor

A full listing of market performance data is available here.

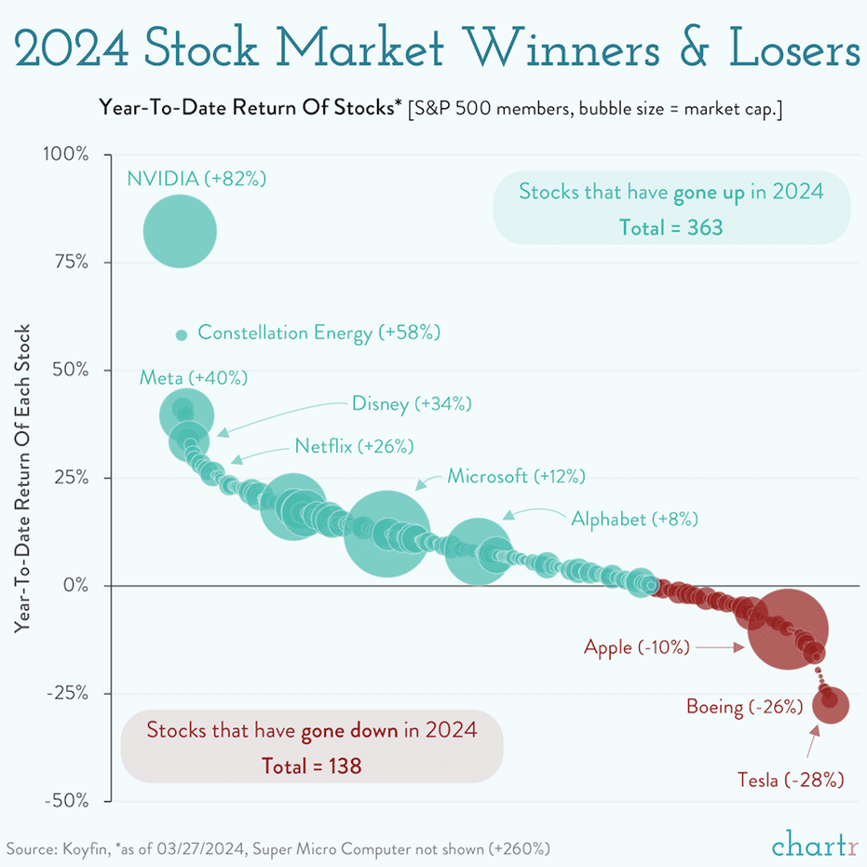

DQYDJ.com (“Don’t Quit Your Day Job”) offers helpful investment calculators here, including one that shows total returns for individual stocks. Koyfin.com provides reams of data on individual stocks, including the ability to track total return — and just about anything else — over time.

In the News

Employers added 303,000 jobs in March on a seasonally adjusted basis, the Labor Department reported on Friday, and the unemployment rate fell to 3.8 percent, from 3.9 percent in February. Expectations of a recession among experts, once widespread, are now increasingly rare. It was the 39th straight month of job growth. And employment levels are now more than three million greater than forecast by the nonpartisan Congressional Budget Office just before the pandemic shock. The resilient data generally increased confidence among economists and market investors that the U.S. economy has reached a healthy equilibrium in which a steady roll of commercial activity, growing employment and rising wages can coexist, despite the high interest rate levels of the last two years.

U.S. factory activity unexpectedly expanded in March for the first time since September 2022 on a sharp rebound in production and stronger demand, while input costs climbed. The Institute for Supply Management’s manufacturing gauge rose 2.5 points to 50.3 last month, according to data released Monday. While barely above the level of 50 that separates expansion and contraction, it halted 16 straight months of shrinking activity.

The Institute for Supply Management’s non-manufacturing survey slipped to 51.4 from 52.6 in the prior month. These companies, ranging from retail to recreation, dominate the modern U.S. economy. Numbers over 50 are viewed as positive for growth. The index hovered between 50 and 55 in 2023.

U.S. employment figures contain a mystery that has left many economists scratching their heads: How is the country generating so many jobs even while the unemployment rate has drifted up? Rising immigration is the emerging consensus.

Lots of Americans are worried about gasoline prices. The full impact of the containership crash that downed a Baltimore bridge Tuesday is still unclear. But the disaster stands to snarl shipping along the East Coast for months. Companies that transport cars and coal, two of the important categories of cargo that run through Baltimore, already are looking for alternative terminals.

Charts of the Week

Good Reads

I found the following articles to be of note. Some may be of interest only to advisors while others are aimed more broadly. You may hit paywalls below; many can be overcome here.

Madison’s Investment Quarterly for Q1 2024 is available here.

- Rethinking Risk (Jack Raines)

- 4 Must-Dos Before Tax Season Wraps Up (Christine Benz)

- Here’s How Much Investors Should Have Saved for Retirement at 5 Different Ages: 2024 (Michael S. Fischer)

This is the best thing I saw or read in the last week. The smartest. The scariest. The most satisfying. The most important. The world is complex. Live music. Not serious. How the “Yale Model” has fared recently. Gaslighting. Lotteries.

Apple has created something on the order of $2.7 trillion in wealth from its IPO in 1981 to the end of 2022, more than any other company. During that same period, Apple stock suffered three drawdowns of 70 percent or more.

“Nothing in life is as important as you think it is when you are thinking about it.”

~ Daniel Kahneman

Securities and advisory services are offered through Madison Avenue Securities, LLC, a member of FINRA and SIPC, a registered investment advisor. This report provides general information only and is based upon current public information we consider reliable. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures, or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment, or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Diversification does not guaranty against loss in declining markets.